december child tax credit 2021

The 2021 CTC is different than before in 6 key ways. Ad Register and Subscribe Now to work on your IRS Individual Forms more fillable forms.

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Free Tax Tutorials 2022 - Online Tax Training - Pass Tax Consultant Certificate Now.

. In this case the taxpayer had received a W-2 reporting such a difficulty care payments. Posted Monday August 22 2022. Browse reviews directions phone numbers and more info on Tax Credits LLC.

In absence of a January payment though the monthly child poverty rate could. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. For each qualifying child age 5 and younger up to 1800 half the total.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. The 2021 advance was 50 of your child tax credit with the rest on the next years return. The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year.

Ad Best Tax Consulting Training Updated - Become Certified Tax Consultant 100. The taxpayer had not included the payment in income following Notice 2014-7 but. For eligible families each payment is up to 300.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. Ad Free means free and IRS e-file is included. 242 Old New Brunswick Suite 145 Piscataway NJ 08854 45 Knightsbridge Rd Piscataway NJ 08854 Categories.

Max refund is guaranteed and 100 accurate. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Extended Tax Collector Hours on Aug.

The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the rollout to 593 million children in July. December S Payment Could Be The Final. 26 for property tax.

Tax Credits LLC has handled over 1450 transactions. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. Most eligible families received payments dated July 15 August 13 September 15 October 15 November 15 and December 15.

The North Bergen tax collectors office will have extended hours on Friday Aug. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000. Complete Edit or Print Tax Forms Instantly.

List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB. Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of the. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

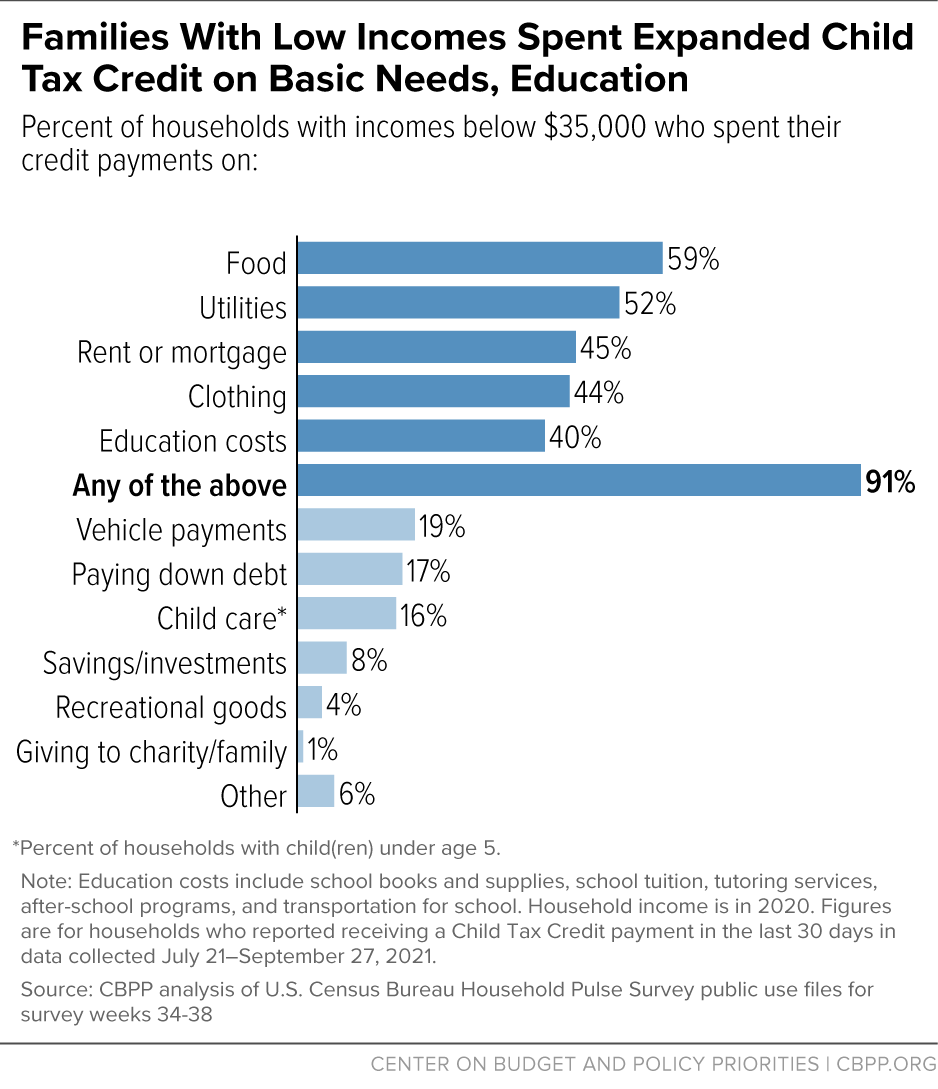

The sixth Child Tax Credit payment kept 37 million children from poverty in December. Child tax credit for. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between. The total child tax credit of 10500 is correct.

Child Tax Credit 2022 Are You Eligible For Money From Your State Cnet

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Child Tax Credit Requirements To Obtain A New Direct Payment For Up To 750 Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Here Is Why You May Need To Repay Your Child Tax Credit Payments Forbes Advisor

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

What Are Marriage Penalties And Bonuses Tax Policy Center

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

A State By State Look At How Families Used The Expiring Child Tax Credit

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy